5 Questions to ask when buying carbon offsets

by: Liam Speden; Deep Blue Institute Senior Advisor

Five key questions for executives to ask to ensure that carbon offsets achieve their desired business objectives

For the past decade, the Voluntary Carbon Market (VCM) has been a popular way for organizations seeking to reduce their carbon impact by buying carbon credits or offsets. Carbon calculations are a complex technical activity requiring specialist expertise, tools, and data. The VCM provided a simple, accessible way for an organization to estimate their carbon footprint and purchase credits or offsets from certified sources.

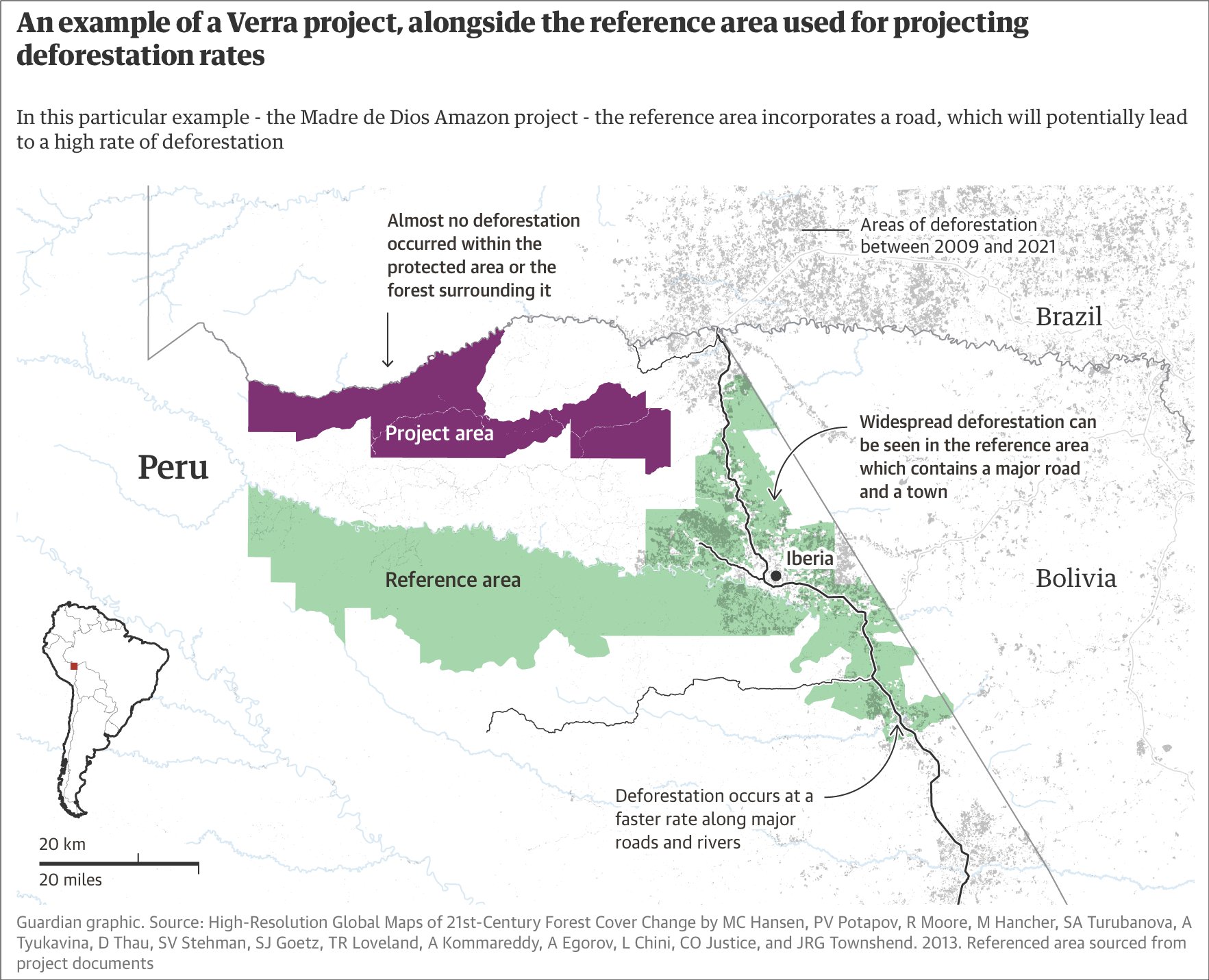

However, recent investigations by The Guardian raised concerns about the quality and value of offsets listed on the largest VCM exchanges such as Verra and ACR, with potentially up to 90% of projects significantly overstating their carbon value and potentially even worsening global emissions. Everything from the assessment and evaluation methods to how projects are audited, operated, and managed has come into question.

The significant and continuing media coverage given to these assertions has raised the awareness of investors, board members, and stakeholders to the potential issues associated with carbon credits and offsets through the VCM. Business leaders need to expect that more activist investors and stakeholders will start to ask questions about an organizations’ purchases through the VCM and the level of due diligence and accountability applied when evaluating and selecting projects to invest in.

To prepare to answer these questions and make better informed decisions, executives can benefit from asking five key questions:

1. Why is my organization looking to buy carbon offsets?

Many organizations buy offsets as an easy way to achieve carbon objectives without having to develop a coherent and comprehensive decarbonization strategy. The knowledge and technology associated with decarbonization has evolved rapidly in the past 10 years, so organizations should evaluate whether carbon offsets are the best expenditure in comparison to investing in other activities that can have a more profound cost and business impact.

2. How will the offsets achieve my organization’s carbon objectives?

Once the level of carbon to be offset has been determined, the type of project can be chosen. There are fundamentally two types of projects in the VCM: emission avoidance and sequestration. Emission avoidance projects, which make up the bulk of projects on most of the exchanges, seek to reduce greenhouse gasses from entering the atmosphere by preserving existing carbon retention, such as through the preservation of old-growth forests or ‘sustainable’ practices such as regrowth for timber, or by decreasing the release of powerful greenhouse gasses such as methane and nitrous oxide. Sequestration projects seek to permanently (usually, for at least 100 years) capture carbon from the atmosphere and trap it through some mechanism, such as increasing the stored biomass of habitats such as wetlands, creating carbon-rich inert materials like biochar, or through carbon capture technologies like atmospheric extraction. Notably, emission avoidance projects do nothing to reduce existing atmospheric carbon and make up the bulk of the projects with questionable value and validity. For these reasons, preferences should be given to sequestration projects.

REDD+ projects to avoid deforestation, the type of projects covered by the Guardian study, represented 25% of total credits traded on the voluntary carbon market in 2019.

3. Who will provide, evaluate, audit, manage, and maintain my carbon investments?

To reduce the risk of selecting a poor performing project, each provider needs to clearly describe how - and how often - the performance of the project is independently evaluated and audited and the associated measurement and reporting mechanisms. In addition, each project must have a clearly articulated management and maintenance program. Many of the questionable projects identified during the recent investigations suffered from good intentions but poor execution: new-growth forests were not maintained and suffered die-back; biomass growth did not meet expectations; reference areas overstated potential emissions; technologies used more fossil fuel energy and created more carbon than they captured; environmental events such as fires destroyed old-growth forests because fuel loads were poorly managed.

4. What guarantee is there on the project’s carbon performance?

The carbon cycle is complex and subject to the effect of a wide range of variables. The science and technology around measurement and evaluation are continually evolving, which may affect the future estimates and value of a project. If a project does not achieve its carbon targets, the balance needs to be made up through a guarantee provided either by the project or the exchange or broker through which the offset was purchased. This guarantee needs to be part of the purchase agreement and in a recognized jurisdiction.

5. Where is the project located?

One attractive aspect of the VCM is the ability to buy offsets anywhere in the world, theoretically directing investment to local and regional economies in underserved countries to improve and preserve ecosystems and create new opportunities for communities. While this is a noble objective, it can also make independent evaluation and reporting more challenging. Further, there are in many countries a range of local projects aimed to restore and regenerate local ecosystems. Selecting a portfolio of global and local projects can demonstrate thoughtfulness in both the impact and management of the risks of carbon projects performance by spreading investment across projects with different methods and locations, including communities in which the organization operates.

While each of these questions can branch out into a tree of additional enquiries, focusing on the highest level business aspects can help keep attention on the functional elements and avoid being dragged into technicalities or marketing hyperbole. Asking and answering these five key questions can help an executive ensure they have considered the reasons for purchasing carbon offsets, allowing for the thoughtful selection of the most suitable projects to achieve the organization’s carbon goals.

If you would like to know more about carbon offsets and creating a comprehensive decarbonization strategy, please contact info@deepblue.institute. The Deep Blue Institute is committed to working with businesses, innovators, communities, and activists to architect lasting sustainable solutions to the world’s most complex challenges. Discover more at www.deepblue.institute or check out The Blue Economy Primer podcast.

Author:

Liam Speden

Senior Advisor; Deep Blue Institute

Liam is an experienced business leader with over 25 years’ experience shaping and implementing transformative business solutions which deliver innovation and improved performance in both public and private sectors.

REFERENCES AND LINKS:

Revealed: more than 90% of rainforest carbon offsets by biggest certifier are worthless, analysis shows; Patrick Greenfield - The Guardian, January 18th, 2023

Revealed: top carbon offset projects may not cut planet-heating emissions; Nina Lakhani - The Guardian, September 19th, 2023

The Carbon Con; The world’s biggest companies, from Netflix to Ben & Jerry’s, are pouring billions into an offsetting industry whose climate claims appear increasingly at odds with reality; Source Material, January 18th, 2023

Is it true that 90% of carbon credits are worthless?; César Dugast - Carbone4, January 26, 2023

Can We Fix Carbon Offsets?; Alejandro de la Garza - Time, September 25th, 2023

A practical guide for corporations to navigate the voluntary carbon markets; Nasim Pour, Dale Hardcastle, Henning Huenteler, Sara Figel - World Economic Forum, September 26th, 2023

If you enjoy this article, please consider supporting Deep Blue Academy’s non-profit education and research work by making a tax deductible donation today.